This process applies to both pre and post filing corrections.

If you are Pre-Filing – Follow the process as outlined below:

If you are completing the submission of your IRS filing – status should read: Accepted With Errors. Congratulations, you are on your way. You now have corrections to make on some of your employees. The corrections will be identified in an email to you outlining specifically which employee is impacted:

Why are you receiving a corrections request – This is an employees’ or possibly dependents’ name that doesn’t match up to their SSN in the IRS’s database. We are seeing a number of these especially on dependents.

When do the corrections need to be completed – These corrections need to be made within as soon as possible through your HCM File Portal

Next Steps:

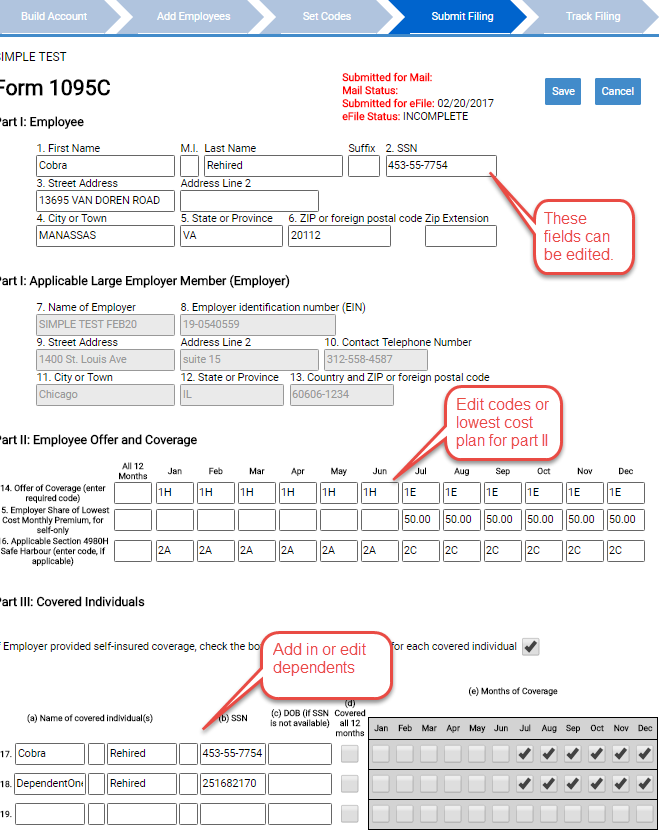

- Click on the “Submit Filing” tab

- Click on Edit 1095s and search for the employees with needed corrections above

- Click “edit” and make the corrections needed and save. Often you will determine that there is no issue with this SSN. I would check to make sure the legal name matches up.

- Then finally go back to the main submit filing screen and click on “Submit IRS Filing” – the corrected records will be sent to the IRS. Status will appear in the portal track filing.