ACA Compliance Check-Up In Six Questions

1.

Are you an ALE? And the basic math behind it

Under the ACA’s Employer Mandate, ALEs, or employers with 50 or more full-time employees and full-time equivalent employees (FTEs) need to comply. FTEs are calculated by looking at the prior Calendar total full-time employees (those working 30 or more hours per week) plus a calculation for the part timers (under 30-hour employees) using the number of hours worked in a month divided by 120. If the total equals 50 or more, you are an ALE and must file for the following tax year. Also note if you have common ownership some aggregation rules can also apply to this math.

For example, in 2021 Employer ABC Corp averaged 40 full time and 20 employees working an average of 60 hours a month. 40 +10 (20 PT x 60/120) = 50 and should file for 2022.

2.

Are you Self-Funded and Under 50?

You may be surprised to note that employers under 50 FTEs that are not ALEs but are self-Funded must file a 1095-B form. This is sometimes supported by your health insurance carrier but also may require a provider to complete this filing. Check with your insurance provider on the topic.

3.

If you are an ALE what are your obligations under the law?

ALEs must offer Minimum Essential Coverage (MEC) to at least 95% of their full-time employees (and their dependents) that meets Minimum Value (MV). The specifics of MV and be determined by your insurance consultant, but most plans today comply with this standard. Additionally, you must ensure that the coverage for the full-time employee is affordable based on one of the three IRS-approved methods. The ACA affordability threshold for 2022 is 9.61%.

4.

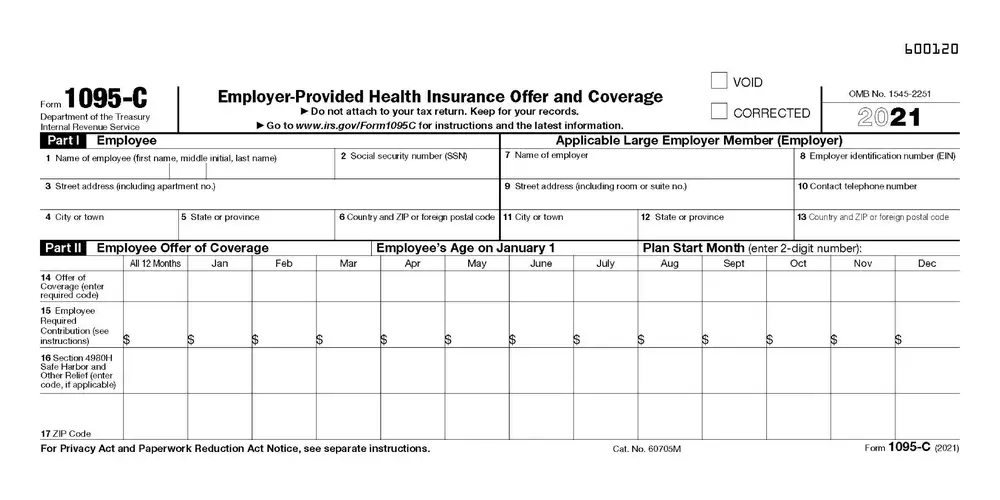

When are employers required to file?

ALEs must comply by delivering 1095 forms to their employees and filing with the IRS by the set deadline dates. The first deadline (forms to employees) has been permanently extended to March 2 from the original date of 1/31. The IRS paper filing deadline is the end of February. Due to change in the law most employers are opting for the electronic filing method which has a deadline of 3/31.

5.

After filing are you finished with your obligation?

Not necessarily. Depending on how the IRS responds back to your filing there are additional actions to take. Here is a summary of the most common statuses:

Accepted – Rarely issue but means (in most cases) the IRS didn’t identify any issues with your data and you have satisfied your requirement with no further actions required.

Accepted with Errors: Like the accepted status but means the IRS has identified a discrepancy with your submission. Often, we see the IRS flagging a SSN/Name mismatch in one of the 1095-C forms submitted. These errors should be corrected if the record is deemed to be incorrect as soon as possible.

Rejected means the IRS was unable to accept your data and you will need to resubmit. The deadline to resubmit is 60 days from your date of notice.

6.

What to do if I get an IRS penalty Notice?

There are three primary types of penalties for noncompliance with the ACA.

The first is due to simply not filing (Letter 5699) or not filing on time (Letter 972CG).

The second type is not meeting the 95% threshold or failure to provide coverage that meets Minimum Value (Letter 226-J §4980H(a).

The third relates to PTC credits received by a full time (30 hour) employee. This is an employee who is triggering an employer penalty and may be either incorrectly reporting full time employment or claiming subsidy when coverage was affordable – Letter 226-J §4980H(b). In this case employers should have already received an Exchange Notice of a potential ACA employer mandate penalty.

Next Steps

When you receive an IRS proposed penalty letter prompt response will yield the best results. In the IRS letter you receive a response date is provided which is usually 30 days from the date of issue. If possible, start remedying the process right away to incorporate the remedy in your response. It could be as simple a solution as an incorrect checked box on the 1094 to a full submission of your annual filing. In the case of being penalized for employees claiming PTC credits if the employee was offered affordable coverage, you must complete form 14765 showing corrected offer and safe harbor codes and provide proof supporting your response.

Need help?

Since 2014, thousands of employers have trusted EmployeeTech’s HCM File solution for their ACA filing needs. EmployeeTech’s white glove approach provides comprehensive support from the initial data gathering to post filing support. As a leader in ACA filing, EmployeeTech can accept data in a variety of formats, provides past due filing (back to 2016), State-based filing and can handle complex employer structures.