Register for ACA 2016, Legislative Update- What Employers Need to Know on Aug 31, 2016 1:00 PM CDT at: https://attendee.gotowebinar.com/register/207502410046102275 Please join us on Wednesday August 31st at 1 PM Central for a legislative update on ACA for 2016. With a year of filing under our belt and new details from Washington, employers will be looking […]

read more

Here’s a link to the draft 2016 1095-C form for 2016. The form is unchanged from 2015. One update worth noting is the plan start month will remain an optional field for 2016. HCM file will be populating this field in 2016.

read more

It’s almost June and the 1094/95 filing that most of us thought would be history by now is still a work-in-progress for many. Having completed filings for nearly2000 employers (ALEs) in 1st quarter, I thought this would be a great time to share the lessons learned that can inform us for next year. Lesson #1: […]

read more

As January 2016 is fast approaching the 6055 and 6056 tax filing has many employers and their advisors up in arms. The increased penalty amounts announced in July are alarming. A single 1095-C form violation could result in a penalty of $500 per form with no cap if the employer shows intentional disregard – basically […]

read more

By now, some of your clients have come to you with a problem: How do I address this tax filing for IRS 6055/56? For some reason, their payroll vendor is unable to deliver or wants an arm and a leg to do the filing. You hold out hope that somehow this will blow over and […]

read more

During the late ’90s, when employee self-service was making its break into the HR market, many of us were mesmerized with the new vendors that entered the market demonstrating Web-based benefit enrollment solutions. At that time, the concept of no longer having to use forms, applying eligibility rules automatically, collecting elections and delivering enrollment data […]

read more

During the late ’90s, when employee self-service was making its break into the HR market, many of us were mesmerized with the new vendors that entered the market demonstrating Web-based benefit enrollment solutions. At that time, the concept of no longer having to use forms, applying eligibility rules automatically, collecting elections and delivering enrollment data […]

read more

Click Here To Download Printable Version When I examine a business problem I often find myself coming back to the classic fairy tale, Goldilocks and the Three Bears. One area that aligns with Goldilocks’ concept of finding what is “just right” for her needs is the quest to find the right approach for filing and […]

read more

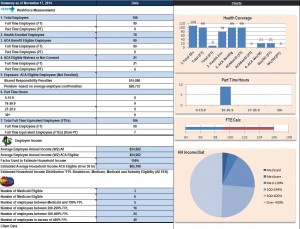

Many employers are relying on incomplete information to make key decisions relating to ACA and plan sponsorship. Dropping plans, meeting affordability or maintaining status quo may not be the best strategy. But, without the right information from their benefit advisors, clients end up confused or compelled to make poor decisions.Going into 2015 benefit practitioners will […]

read more

Click on a desired date to register 12/9 , 12/11 or 12/16, all @ 1 PM Central About the Webinar Understanding HR and benefits technology today requires a greater focus on compliance, especially when it comes to tracking and reporting for The ACA. For over a year EmployeeTech has been working to provide the perfect analysis of […]

read more