As we are approaching 2015 we are entering into a new era in employer sponsored healthcare where accountability of health coverage is the new normal. When I say accountability I mean When, Who and What. When is when you elected coverage into your health plan, and for what period of time in 2015 (e.g. January- […]

read more

As we are approaching 2015 we are entering into a new era in employer sponsored healthcare where accountability of health coverage is the new normal. When I say accountability I mean When, Who and What. When is when you elected coverage into your health plan, and for what period of time in 2015 (e.g. January- […]

read more

Click here for September 2014 new reporting release.

read more

Download a copy of the article here

read more

By Michael Weiskirch The continued challenges imposed by The ACA come in two primary forms; 1. Regulations that negatively impact health plan sponsorship such as PCORI, Reinsurance and HIT taxes or 2. Regulations that create extra work, for example W2 reporting or variable hour tracking. It’s the second category that employers start to become front-and-center […]

read more

HIU April Issue

read more

EmployeeTech is pleased to introduce HealthCostManager an ACA analysis solution for managing health plan sponsorship. Since the passing of the Affordable Care Act, a company’s sponsorship of health plans has become an increasingly daunting task. Not only do they need to offer competitive health plans, but often the employer has to be mindful of their […]

read more

In the May 2013 issue of Employee Benefit Adviser EmployeeTech’s Principal, Michael Weiskirch writes about how technology addresses the biggest challenges of health reform. Click here to download

read more

Deerfield, IL, [3/24/2014] since the passing of the Affordable Care Act, a company’s sponsorship of health plans has become an increasingly daunting task. Not only do they need to offer competitive health plans, but often the employer has to be mindful of their plans affordability, new taxes and penalties and the possibility that some employees […]

read more

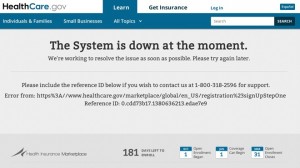

It’s been a rough series of weeks for the Federal Exchange (Healthcare.gov) and consequently ObamaCare as a whole. As of today Healthcare.gov, the website that runs most of the public exchanges is down. Recent events leave many of us asking the question “how did we get to this point?” There’s certainly a lot to be […]

read more