The Growth of ICHRAs and Their Impact on The ACA – A Brief Tutorial

By Michael Weiskirch, Principal of EmployeeTech

According to the HRA Council 2022 Growth Trends Report, ICHRA Adoption by U.S. Employers Has More than tripled from 2020 to 2022. Often referred in the industry as the “the 401(k) of health coverage,” ICHRAs combine the freedom of plan selection at the employee level, the tax-free benefits at the employer level and elimination of direct plan experience risk for employers. This level of independence between the employer and employee is compelling and driving growth particularly in the small employer market. At the same time, larger employers are starting to implement these plans, but they tend to face further challenges around the affordability requirement that exists if they are an Applicable Large Employer (50 or more FTEs). In addition their ACA filing requirements are more complex.

The Administrative Challenges with ICHRAs and The ACA

The main challenge for ICHRAs stems from the fact that employers who are ALEs must offer a reimbursement that is not tied to an employer’s composite rate, but rather the specific employees’ silver based on their age and residential location. To meet ACA affordability guidelines the ICHRA monthly reimbursement amount offered by an employer must be greater than the employees’ lowest cost silver, self-only plan minus 9.12% of an employee’s household income (for 2023).

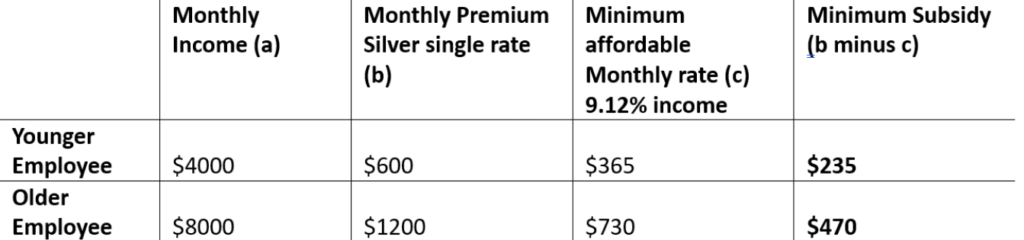

This means each employee offered coverage through the ICHRA plan requires a unique affordability calculation to ensure compliance. The design of employer reimbursement can be tricky often resulting in different employer contribution amounts based on each employee cost for the silver plan. So, for instance, let’s look at the scenario where a younger employee with an income of $4000/mo. an older employee making $8000/mo. This employer is looking to fund at the minimum level required by law.

In this case the younger employee’s silver plan costs $600/mo. and older employee’s cost $1200 the affordable contribution would be $365 ($4000 x .0912) and $730 respectively. Subtracted from the monthly premium would net $235 and $470 in required subsidy.

Furthermore, the 1095-C form usually is much more complicated to code when working with ICHRA plans. Line 15 of the 1095 C form is looking for the cost of the least expensive silver plan for each employee at the single (employee only) rate regardless of the actual tier the employee chooses. Based on the calculations referenced above, the amount for each employees’ line 15 code will need to be uniquely calculated as well. It is worth noting that employers under 50 FTEs must still file their 1095 B form. This filing does not disclose the amount of cost required by the “C” filing but still means all ICHRA plans have some form of filing requirement since they are considered self-insured.

Over the last two years we have seen an influx of ICHRA plans for ACA filing come through our door for both B and C. We can handle both, but requires a bit more involvement by the broker and their client in nailing down the line 15 contribution amount. As ICHRA plans continue to grow in the market we will look for ways to facilitate and streamline the ACA filing process. Like many things we do, we rely on the broker community to provide feedback when it comes to creating many of our best practices.