Published on Shortlister For the nearly 20 years of working in the HR technology space, I have witnessed a healthy and continuous growth in innovation. Employers are automating more of their HR and benefits process faster and more affordably than ever before. And, employees are accessing these tools through their smartphones and other devices at […]

read more

As stated in a memorandum on November 29, the IRS has once again extended the due dates for 1095 B and C forms to be distributed to employees for the 2018 tax year from January 31st to March 4, 2019.. This comes as a welcome relief for employers and insurers. For more information see Notice […]

read more

Please Join us for this 45 Minute ACA update on Thursday October 25th at 1 PM Central (2 Eastern, 12 Mountain and 11 Pacific). Click here register. Description Going into its’ 4th year, The Affordable Care Act has become a part of the yearly routine. In the past year we have seen changes in tax […]

read more

Form 1095-C, Employer-Provided Health Insurance Offer and Coverage Form 1094-C, Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns Instructions for Form 1094-C and Form 1095-C Form 1095-B, Health Coverage Form 1094-B, Transmittal of Health Coverage Information Return

read more

A 2016 study by the International Foundation of Employee Benefit Plans (IFEBP) found that 50% of employees do not understand their benefits materials, and nearly 80% do not read them. The general lack of understanding of benefits poses a challenge, especially with health plans, our most heavily utilized benefit. The selection of the right health […]

read more

This letter is most likely sent due to incomplete or non-existent filing. If the IRS rejected your filing they consider the filing to be not sent until they have either accepted the filing with revisions or accepted it outright. If you didn’t send your filing at all it is recommended that you do so immediately. […]

read more

For the last five years we were a company of two brands; HealthCostManager (HCM) and EmployeeTech. This created confusion in the market from a brand identity standpoint. As of this week we happy to announce we have consolidated everything under the umbrella of EmployeeTech. Underneath that umbrella is our HR technology consulting services and two […]

read more

This is a question that gets asked often these days, especially as we get close to filing time. While there is some degree of uncertainty, most experts agree that ACA reporting will remain a requirement for the 2018 filing season. Below is a brief summary of the Law as we look into 2019: The Individual […]

read more

Starting in November The IRS began sending letter 226J for the collection of potential Employer Shared Responsibility penalties. These penalties are most commonly associated with employees receiving an Exchange subsidy. We anticipate additional rounds of letters to be issued in the weeks ahead. It is entirely possible your client may receive a letter simply based on a mistake […]

read more

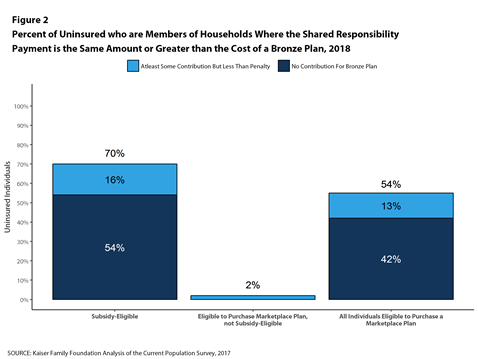

Recent news of 600,000 sign ups into the Federal Health Exchange in the first week provides a small glimmer of hope for the ACA. Nothing more motivating then scarcity – think Black Friday for health insurance. However, the effort to maintain or grow enrollment for the 2018 is unlikely especially when the enrollment period has […]

read more